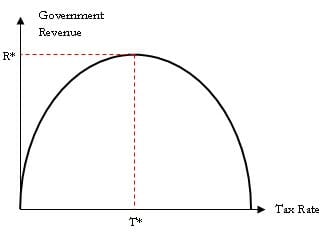

Laffer Curve/

Reagonomics/

Trickle-down/

Universal B.I.

In a two-party system, political combatants shout "tax the rich; redistribute the wealth" or "all taxes do is kill jobs". Nobody acts as a referee considering the whole curve.

Logically, somewhere between those extremes, the government would maximize its revenue. Reagan trade-marked this thinking and because taxes at the time were excessive, "trickle-down" worked when he reduced them.

At that time, production was limited by capital, which by the Savings Identity is in the hands of "the Rich". Only those who have extra income can deploy it into capital and taxes were transferring it into band-aid solutions to help "the Poor". When Reagan reduced their taxes "the Rich" expanded the productivity of factories etc. and got even richer by selling much more at somewhat lower prices.

A third reason cutting taxes worked; the extra production from capital investment needed lots of added workers, and "the Rich" had to pay them a lot more to produce enough to meet the increased demand from lower prices. That created a Middle Class. The government swooped in and got back what it had granted to "the Rich" by taxing it from workers.

The workers did not complain, because their take-home pay was rising faster than ever. Other people tolerated this because taxes still covered band-aid solutions for "the Poor". It worked because at that time

However in 2024, the Middle Class is being suppressed, suggesting that we are on or approaching the declining side of the Laffer Curve and need to adjust the deployment of capital so that Demand can balance Production more equitably between "the Poor" and "the Rich".